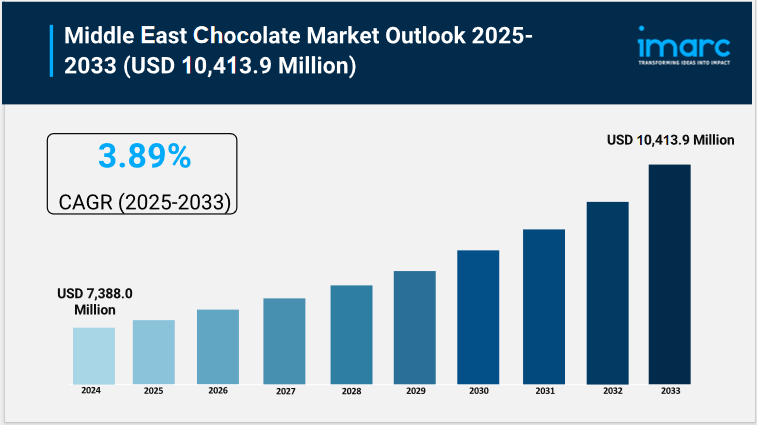

Middle East Chocolate Market Overview

Market Size in 2024: USD 7,388.0 Million

Market Size in 2033: USD 10,413.9 Million

Market Growth Rate 2025-2033: 3.89%

According to IMARC Group's latest research publication, "Middle East Chocolate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Middle East chocolate market size was valued at USD 7,388.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,413.9 Million by 2033, exhibiting a growth rate of 3.89% during 2025-2033.

How Premium Brands and Local Flavors are Reshaping the Middle East Chocolate Market

Rising Premium Segment Demand: The UAE's premium chocolate market alone is projected to reach USD 198.0 million by 2030, with luxury brands like Patchi and Godiva expanding their regional footprint through innovative product lines and customized offerings.

Cultural Fusion Innovation: Middle Eastern chocolatiers are incorporating traditional flavors like saffron, rose, cardamom, and dates into their products, with companies like Forrey & Galland blending French techniques with Arabic tastes to create unique market positioning.

Health-Conscious Consumer Shift: Dark chocolate consumption is growing as health awareness increases, with manufacturers responding by introducing reduced-sugar formulations and highlighting antioxidant benefits to capture the wellness-focused demographic.

Digital Distribution Expansion: Online chocolate sales are surging across the region, with brands investing heavily in e-commerce platforms and digital marketing campaigns, particularly during religious celebrations like Ramadan and Eid when gifting traditions drive demand.

Sustainable Sourcing Focus: Environmental consciousness is influencing purchasing decisions, pushing brands to adopt eco-friendly packaging, ethical sourcing practices, and sustainable supply chain initiatives to meet consumer expectations for responsible consumption.

Grab a sample PDF of this report: https://www.imarcgroup.com/middle-east-chocolate-market/requestsample

Middle East Chocolate Market Trends & Drivers:

The Middle East chocolate market is experiencing remarkable growth, fueled by rising disposable incomes and changing consumer preferences across the region. With countries like Saudi Arabia showing particularly strong momentum, the market benefits from a growing middle class that's increasingly willing to spend on premium and artisanal chocolate products. The cultural tradition of chocolate gifting, especially during religious celebrations and special occasions, continues to drive consistent demand throughout the year. Additionally, the expansion of modern retail infrastructure, including supermarkets, hypermarkets, and convenience stores, has made chocolate products more accessible to consumers across urban and suburban areas.

The health and wellness trend is significantly reshaping chocolate consumption patterns in the Middle East. Consumers are becoming more discerning, showing a clear preference for dark chocolate due to its perceived health benefits, including antioxidant properties and heart health advantages. This shift has prompted manufacturers to innovate with reduced-sugar formulations and organic options. The growing awareness of sustainable and ethical sourcing is also influencing purchasing decisions, with brands increasingly highlighting their commitment to fair trade practices and environmentally responsible packaging. These factors are creating new market opportunities for premium brands that can effectively communicate their value propositions.

The digital transformation of retail is opening new avenues for chocolate brands in the Middle East. E-commerce platforms and online stores are experiencing rapid growth, particularly accelerated by changing shopping habits and increased internet penetration reaching 74% in some regions. Social media marketing and influencer partnerships have become crucial tools for brand awareness and customer engagement. Companies are leveraging these digital channels to showcase their products, share brand stories, and connect with younger demographics who value authentic experiences and unique flavor profiles that reflect both international trends and local cultural preferences.

Middle East Chocolate Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

White Chocolate

Milk Chocolate

Dark Chocolate

Others

Product Form Insights:

Molded

Countlines

Others

Application Insights:

Food Products

Bakery Products

Sugar Confectionery

Desserts

Others

Beverages

Others

Pricing Insights:

Everyday Chocolate

Premium Chocolate

Seasonal Chocolate

Distribution Insights:

Direct Sales (B2B)

Supermarkets and Hypermarkets

Convenience Stores

Online Stores

Others

Country Breakdown:

Saudi Arabia

Turkey

Israel

United Arab Emirates

Iran

Iraq

Qatar

Kuwait

Oman

Jordan

Bahrain

Others

Recent News and Developments in Middle East Chocolate Market

February 2025: Patchi continues to strengthen its position as the leading luxury chocolate brand in the UAE, with CEO Oussama Choucair announcing new sustainability initiatives and expansion of customized gifting solutions, targeting the growing corporate gifting segment that's projected to increase by 25% annually.

March 2025: The GCC confectionery market reached USD 17.63 billion, with chocolate accounting for nearly 40% of total sales. Premium chocolate consumption is driving this growth, particularly in urban centers where consumers are willing to pay 30-50% more for artisanal and ethically sourced products.

June 2025: UAE's chocolate industry is experiencing a digital revolution, with online sales growing 45% year-over-year. Major retailers are investing in temperature-controlled delivery systems and same-day delivery services to maintain product quality, especially during the hot summer months when logistics become challenging.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players including Barry Callebaut AG, Ferrero SpA, Forrey and Galland, Godiva Chocolatier, Patchi, and others.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Write a comment ...